The latest economic figures released by the US Bureau of Labor Statistics confirm what everyone’s been feeling in their wallets—record high inflation.

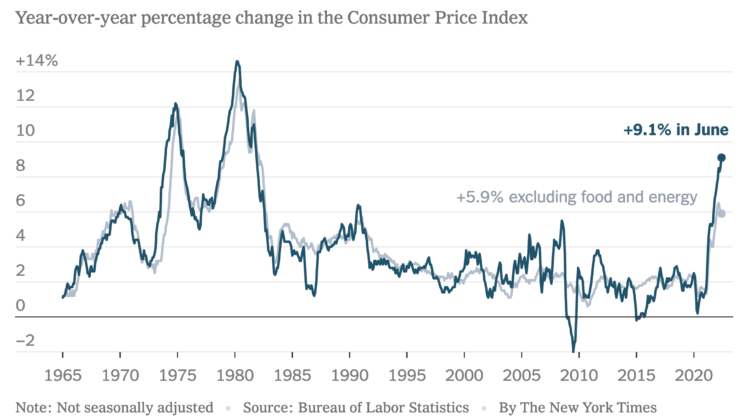

Released earlier today, the consumer price index (CPI) came in at 9.1%. The CPI measures a carefully selected basket of goods and services—the official method for measuring inflation. This is the single largest increase since 1981.

Inflation refers to the average increase of products within an economy, which indicates the loss of purchasing power. For instance, if a gallon of milk cost $8 last year, rising to $8.80, this means that the cost has remained essentially the same—but the value of the dollar has dropped by 10%.

What Prices Increased the Most?

Inflation hit the energy and food sectors most sharply, with unleaded gas prices peaking at a national average of $5 per gallon.

Removing food and energy reduces the rate to 5.9%, confirming that these sectors have risen the most.

While gas prices sharply increased by nearly 50% from last year, the price at the pump has leveled off for the most part since early June, in part due to crude oil price leveling out, falling below their $126 mid-May peak to $96 as of July.

Nevertheless, price discovery for most of the economy remains on the high side.

“The concept of price discovery—determining the fair price of a particular good or service based on supply and demand—is a primary function of every public market, from ancient souks to auction houses.”

Everyone is uncertain how far inflation will go—especially since it’s approaching the mid-70s record highs, whether a small business or a transactional conglomerate. Prices will likely continue to rise as supply chains continue to crumble, supplies decrease due to global trade upset from Ukraine and Western-bloc sanctions, and gouging by oligopolies continues, per the norm.

Price Gouging and Collusion

In simple terms, big businesses pay market analysts to forecast costs and profit changes, advising higher prices even if the impact of inflation hasn’t hit their bottom line. As a result, this triggers inflation across the economy, as large portions of the technology sector are in cahoots with each other, called oligopolies.

While most people believe businesses compete, the increasingly obvious reality is that collusion is more the norm. Why else would most retail and tech prices seem to go up at once in response to a crisis like the Ukraine conflict?

As Wall Street Journal Reporter Dion Rabouin notes in an NPR interview from April of this year,

“Inflation sort of disguises these price increases. When prices for everything around you are rising, it’s much easier for companies to raise their prices and not experience that consumer blowback.”

True Inflation Much Worse

As bad as things appear with 9.1% inflation, it’s a lot worse.

A campaign to suppress real inflation started in the 80s as a response to increasing liability obligations for social security beneficiaries.

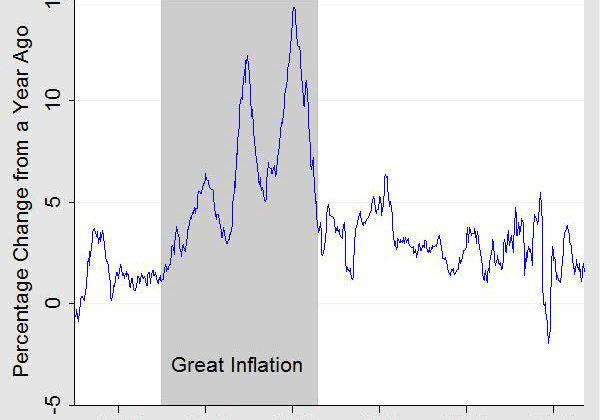

In the 1970s, before the calculation methods changed, inflation spiked to nearly 15%.

But, strangely, after changes were implemented, the volatility of inflation was reduced.

According to Investopedia,

“Originally, the CPI was determined by comparing the price of a fixed basket of goods and services spanning two different periods. In this case, the CPI was a cost of goods index (COGI). However, over time, the U.S. Congress embraced the view that the CPI should reflect changes in the cost to maintain a constant standard of living. Consequently, the CPI has evolved into a cost of living index (COLI).

Over the years, the methodology used to calculate the CPI has undergone numerous revisions. According to the BLS, the changes removed biases that caused the CPI to overstate the inflation rate. The new methodology takes into account changes in the quality of goods and substitution. Substitution, the change in purchases by consumers in response to price changes, changes the relative weighting of the goods in the basket. The overall result tends to be a lower CPI. However, critics view the methodological changes and the switch from a COGI to a COLI as a purposeful manipulation that allows the U.S. government to report a lower CPI.”

This issue is quickly summarized in a Dirty Money video entitled Why the Official US Inflation Rate is a LIE.

John Williams, a maverick economist, reveals the true inflation numbers on his site Shadowstats.com.

According to Williams’ charts, a more accurate inflation figure is about 17%—nearly double the adjusted mainstream number of 9.1%.

Note in the above chart that the two different indexes, SGS CPI in blue and CPI-U in red, were trending in unison until 1982, when the new calculation methods were implemented.

Final Thoughts

Inflation is a hidden tax on the working class—those citizens who don’t have excess capital to invest in the stock market—where prices of stocks tend to rise with inflation.

Inflation reduces the cost of debt due to the fact payments are enumerated in fixed currency amounts—your mortgage payment doesn’t go up or adjust for inflation.

This means inflation favors the wealthy and those with debt, like the US government.

What prices have you seen rise the most? What are you doing to mitigate the impact?

Justin Deschamps is an epistemologist, researcher, and public speaker, passionate about omniology. He discusses a wide range of topics for the betterment of mankind in and through the enhanced capacity to think critically, discern wisely, and expose corruption. He hosts Vigilant News and Knowledge Based on Badlands Media, and writes, produces, and hosts the show Into The Storm on Rise.tv.

Leave a Reply